Citi is a TPG promoting accomplice.

Bank card welcome bonuses are one of many quickest methods to earn useful journey rewards. You may usually choose up 100,000 points or more in a single bonus, which could be worth thousands of dollars in travel.

Proper now, American Airways’ top-tier card is providing its best-ever welcome bonus, value $1,650 (based on our Might 2025 valuations). For a restricted time, those that apply for the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) can earn 100,000 bonus AAdvantage miles after spending $10,000 in three months of account opening.

However what if you have already got the cardboard or have held it prior to now? Are you able to earn the welcome bonus on it once more?

To reply this query, it is vital to grasp Citi’s utility guidelines and establish the precise date if you final earned the welcome bonus on this card. Let me stroll you thru it.

Associated: Is the Citi / AAdvantage Executive World Elite Mastercard worth it?

Understanding Citi’s utility guidelines

On most of its cobranded playing cards, Citi restricts incomes the welcome bonus to as soon as each 48 months. This rule applies to the Citi / AAdvantage Executive World Elite Mastercard.

So, for instance, in case you wished to use for this card in Might 2025 and earn the welcome bonus, you’ll solely be eligible in case you acquired your final welcome bonus on the cardboard earlier than Might 2021.

One of the simplest ways to search out out this date is to name Citi at 888-766-2484. Alternatively, you possibly can additionally name AAdvantage at 800-882-8880. (You may solely see your account exercise by your AAdvantage online account for the previous two years.)

Every day E-newsletter

Reward your inbox with the TPG Every day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Associated: Who’s eligible for the 100K-mile Citi / AAdvantage Executive World Elite Mastercard bonus?

Timing is vital

The 48-month interval begins from the date the earlier bonus was acquired, not when the account was opened or closed.

That is vital as a result of just a few months will in all probability have handed between if you have been authorized for the cardboard and if you met the minimal spending requirement and, thus, acquired the welcome bonus.

Product adjustments

You may earn the welcome bonus on every of Citi’s AAdvantage playing cards as soon as each 48 months — every product is handled individually.

Up to now two years, I’ve utilized for the next three Citi / AAdvantage playing cards and earned the welcome bonus on every:

Nevertheless, suppose I had earned the bonus on my Platinum Choose after which the product modified (or upgraded) it to the Government. In that case, I would want to attend 48 months from after I acquired the Platinum Choose welcome bonus to earn the welcome bonus on the Government.

Methods to maximise bonus alternatives

Listed below are a few of my prime tricks to rapidly earn loads of AAdvantage miles by making use of for cobranded American Airways bank cards.

Work out your utility technique

If you’re assured that you just acquired the welcome bonus in your Government card greater than 4 years in the past and do not at the moment maintain the cardboard, you are good to apply for it again.

Should you do at the moment have the cardboard, first, you may need to downgrade or cancel your card.

My advice can be to downgrade it to the no-annual-fee American Airlines AAdvantage® MileUp® card by calling Citi on the quantity on the again of your card. Nevertheless, notice that by downgrading, you’ll not be eligible for the welcome bonus on this card. The upside is that you’ll defend your credit score rating as there might be no change to your credit score report.

The knowledge for the AAdvantage MileUp card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Alternatively, you may cancel your Government card. Whereas this may occasionally quickly damage your credit score rating as a consequence of a rise in your credit score utilization ratio, chances are you’ll be eligible to earn the welcome bonus on the MileUp must you select to use for it sooner or later.

After downgrading or canceling your card, wait every week or so after which apply for the Executive card again.

Observe bonus timelines

You will have acquired your welcome bonus in your Government card extra lately. In that case, discover out the precise date you acquired your bonus. Then, use a bonus tracking spreadsheet or set a reminder to notice when you’ll be eligible once more.

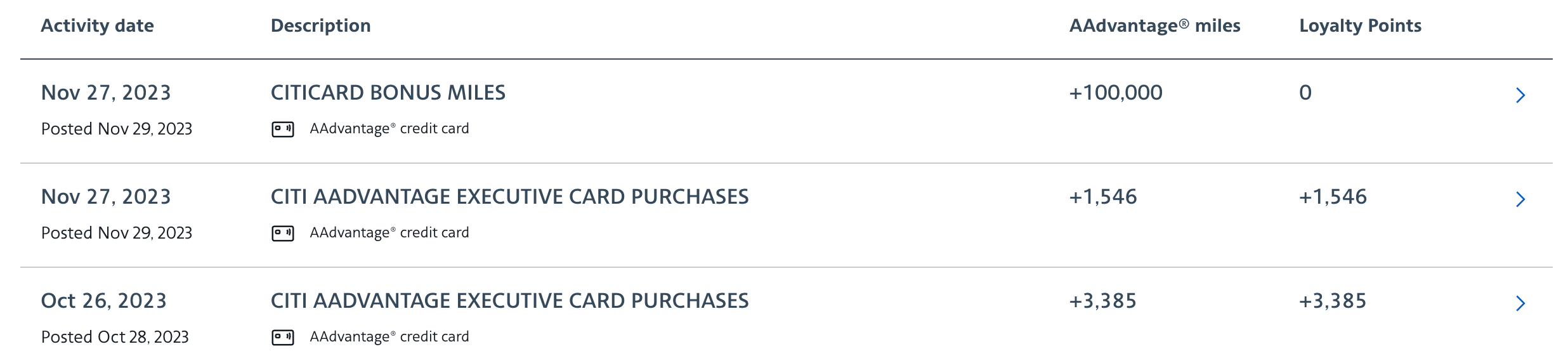

I utilized for this card in July 2023, within the first week after the card was refreshed. Based on my account exercise in my on-line AAdvantage account, I acquired the welcome bonus in November 2023. So, I’ve put a notice in my Google Calendar that I am eligible to use for this card once more from December 2027.

Discover different AAdvantage playing cards

If you wish to choose up extra bonus AAdvantage miles, contemplate making use of for one of many carrier’s other cards.

My prime suggestion can be to choose up the AAdvantage Aviator Red World Elite Mastercard. It is the only AAdvantage card that Barclays is still issuing, forward of Citi becoming the carrier’s sole credit card partner subsequent 12 months. Purposes for this card might shut any day now (and virtually positively earlier than the top of the 12 months).

You’re eligible to use for it if you have not had it prior to now six months. Here’s a link to earn 10,000 extra miles on prime of the card’s standard offer.

The knowledge for the Aviator Crimson World Elite Mastercard has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

If you have not earned the bonus on one in all Citi’s other two personal cards or the business version prior to now 48 months, then they’re good choices too.

Backside line

Citi’s 48-month rule makes timing essential when making use of for its AAdvantage bank cards. By monitoring if you final earned a welcome bonus and understanding how product adjustments have an effect on eligibility, you may make sure you maximize your approval probabilities.

With the 100,000-bonus-mile provide at the moment accessible on the Government card, now could be the time to guage your timeline and take full AAdvantage in case you’re eligible.

To study extra in regards to the card, learn our full review of the Citi / AAdvantage Executive World Elite Mastercard.

Apply right here: Citi / AAdvantage Executive World Elite Mastercard