Numerous cardholders have a big stash of miles saved up, together with companion passes and airline vouchers. One of many vouchers that we get quite a lot of questions on is the $125 American Airways flight low cost from the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®.

It is a fairly worthwhile perk that does not get almost as a lot consideration because it ought to. Cardholders can earn it after spending $20,000 or extra on the cardboard throughout their membership 12 months and renewing their card.

This flight low cost can solely be utilized to income fares, so it can save you cash and nonetheless earn miles in your ticket.

This is all the pieces you could know concerning the flight low cost provided by the Citi AAdvantage Platinum Choose card.

The knowledge for the Citi / AAdvantage Platinum Choose has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

How you can get the $125 American Airways flight low cost

Should you carry the Citi AAdvantage Platinum Choose, you get the $125 American Airways flight low cost each membership 12 months wherein you spend at the least $20,000 on the cardboard after which renew your card.

Your account should keep open for one full billing cycle after your anniversary month to obtain the low cost.

Should you’re in a position to meet this spending requirement, it’s going to greater than offset the cardboard’s $99 annual payment, which has a $0 intro annual payment for the primary 12 months.

An awesome and simple method to hit the $20,000 spending requirement for this flight low cost is to put your rent in your Platinum Choose. So long as your lease is at the least $1,667 every month, you will attain the spending requirement with no need to place some other spend in your card.

Each day Publication

Reward your inbox with the TPG Each day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Simply hold any related charges in thoughts when paying your lease with a bank card.

You will find yourself with at the least 20,000 American Airlines AAdvantage miles from spending to achieve that threshold. In accordance with TPG’s March 2025 valuations, that haul of miles is price $330.

You will obtain the flight low cost within the mail eight to 12 weeks after assembly this spending requirement.

Keep in mind that you will earn 1 Loyalty Level for each mile you earn, placing you nearer to incomes AAdvantage elite status. In actual fact, in case you spend precisely $20,000 on the cardboard, you will earn 20,000 Loyalty Factors — placing you midway to AAdvantage Gold.

Associated: Chasing American Airlines elite status? Here are 15 ways to earn Loyalty Points

How you can redeem the American Airways flight low cost

Redeeming the $125 American Airways flight low cost could be very simple: To start out, seek for and choose the airfare you are inquisitive about on aa.com as you often would.

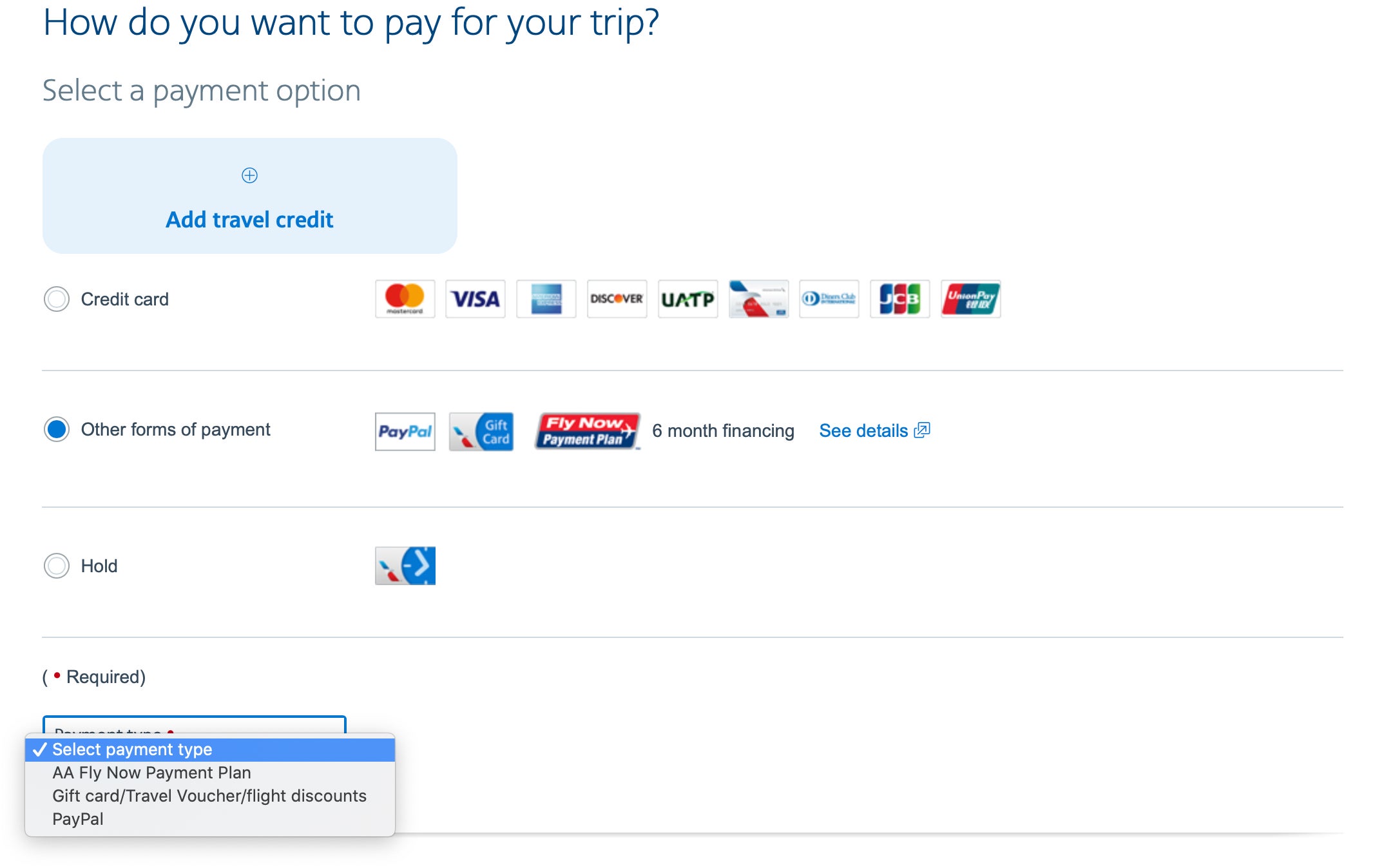

On the fee web page, you will want to pick out “Different types of fee” and select the “Reward card/Journey Voucher/flight reductions” possibility.

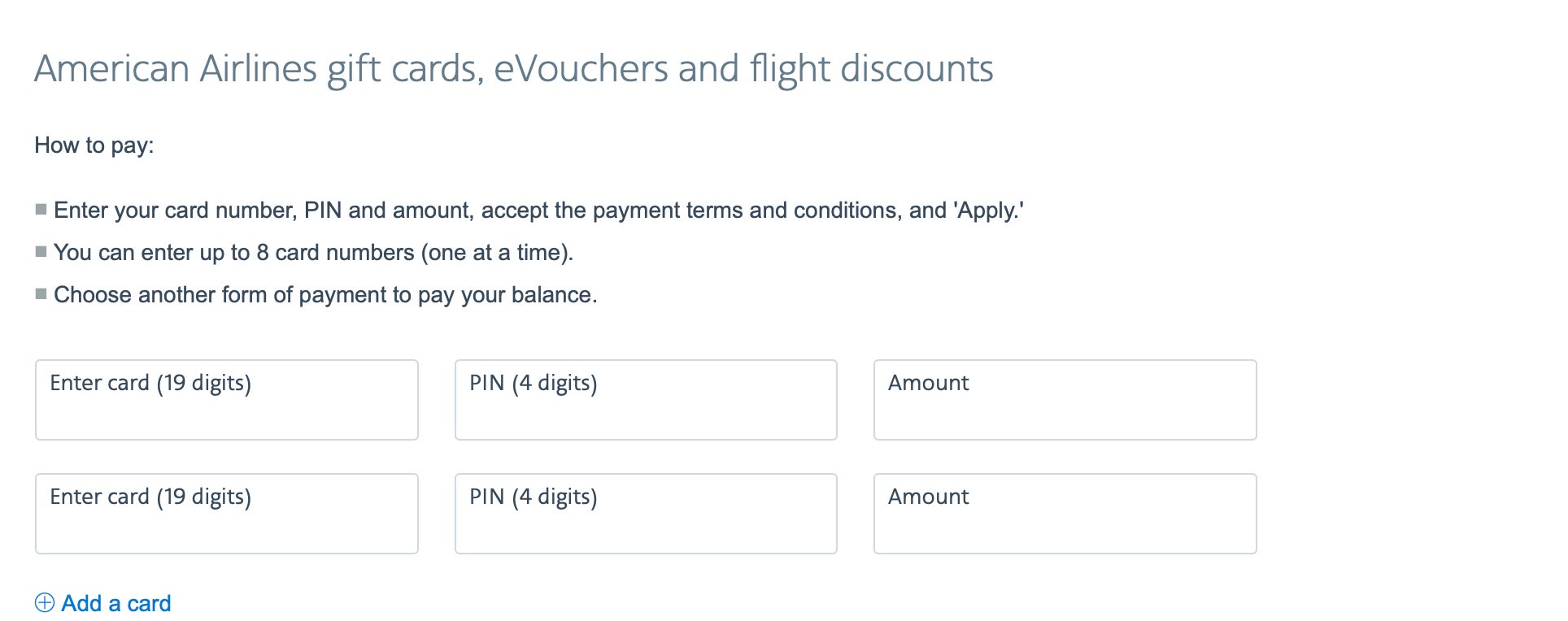

You will have to enter your low cost code. In case your flight prices greater than the low cost code, you will want to offer an extra type of fee.

Associated: Best credit cards for American Airlines flyers

FAQs concerning the $125 American Airways flight low cost

When does the $125 American Airways flight low cost expire?

The $125 American Airways flight low cost expires one 12 months after it is issued. You probably have the Citi AAdvantage Platinum Choose, chances are high you fly American at the least annually. As such, redeeming the $125 flight low cost earlier than it expires should not be a difficulty.

Can I exploit my American Airways flight low cost to ebook airfare for another person?

The beauty of the American Airways flight low cost is that you should utilize it to ebook flights for different folks. A few years in the past, my brother determined on the final minute to attend his pal’s commencement ceremony in Los Angeles. It was simply an hourlong flight.

He known as me asking which credit card to use for a last-minute $200 fare. Along with card recommendation, I gave him my American Airways flight low cost code and he utilized it at checkout, dropping his out-of-pocket price right down to about $75.

Can I exploit the American Airways flight low cost on different airways?

Whilst you can redeem the $125 American Airways flight low cost for different folks, there are restrictions about which airways you may apply it to.

The low cost is legitimate on American Airways-owned and -marketed flights and American Airways codeshare flights. Flights should originate within the U.S., Puerto Rico or the U.S. Virgin Islands, and you need to ebook the ticket on American’s web site or by calling American Airways’ reservations division (the latter of which can incur a service payment).

What occurs in case you cancel or change your flight?

Should you cancel or change a ticket booked with an American Airways flight low cost, your low cost won’t be reissued. Nevertheless, it definitely would not harm to ask an airline representative if they’re going to situation you a journey voucher or airline miles as a substitute. They are not obligated to, and there is no assure you will be accommodated, but it surely’s price a strive.

Do I earn miles on the ticket?

Because you’re utilizing the low cost on a normal income ticket, you’ll earn miles in the AAdvantage program based mostly on the unique worth of the flight. This, too, will earn you Loyalty Factors, placing you nearer to reaching elite standing.

Backside line

The Citi AAdvantage Platinum Choose’s flight low cost is a helpful recurring card perk you will get in case you’re in a position to meet the $20,000 spending requirement yearly. It has saved me cash on last-minute bookings earlier than and may actually come in useful for last-minute ticket purchases.

Since bank card spending helps you attain AAdvantage elite standing, that is much more of a motive to push for this profit.

To study extra, try our full review of the Citi AAdvantage Platinum Select.

Associated: Is the Citi / AAdvantage Executive World Elite Mastercard worth it?