Many perks accessible out of your bank cards are well-known and well-utilized. Nevertheless, advantages corresponding to trip cancellation insurance, delayed baggage insurance, lost baggage insurance and trip delay protection can fairly actually save the day and justify paying an annual payment.

I am going to clarify a few lesser-known advantages that you simply hopefully will not have to make use of however, if wanted, can shield you from excessive monetary hardship and guarantee your loved ones and family members are supplied for if one thing occurs to you.

You possibly can simply discover the protection and phrases of any safety your journey bank card affords by doing a fast net seek for the cardboard’s up to date advantages information. These advantages aren’t unique to travel credit cards, and plenty of customary bank cards include journey safety and insurance coverage.

Journey accident insurance coverage

Typically known as common carrier insurance, this coverage pays in case of demise, lack of eyesight or lack of limb(s) whereas on a airplane, practice, ship or bus licensed to hold passengers and accessible to the general public.

A couple of playing cards even have journey accident insurance coverage that gives safety for all the period of a visit (as much as 31 days lengthy) however pays out lower than the frequent provider insurance coverage insurance policies. To be eligible, you could sometimes pay for all the fare along with your eligible bank card.

Completely different bank cards have totally different fee tables for a way a lot your beneficiary would obtain in case of demise, shedding one limb, shedding two limbs, shedding sight in a single eye or changing into legally blind. Protection can also be sometimes prolonged to licensed customers on the account, spouses, home companions and dependent youngsters of the cardholder on journeys paid for with the cardboard.

By default, the beneficiaries so as of priority are spouses, youngsters after which property. You possibly can submit a letter to the cardboard issuer to determine one other beneficiary.

Emergency evacuation insurance coverage

Prior to now, when touring to distant locations like the Maldives and Fiji, I purchased third-party emergency medical evacuation insurance coverage, not realizing the playing cards I already had would have lined me. There are a couple of essential points of emergency evacuation insurance coverage supplied by bank cards that you could perceive and observe so you do not compound your medical scenario with the stress of monetary hardship:

- All the things should be permitted and coordinated by a advantages administrator. That is who you or your companions ought to name when issues first begin to seem like you may want help. You’ll not be reimbursed for something that you simply determine to pay for by yourself.

- Evacuation doesn’t imply repatriation. For those who’re far abroad, you will not be evacuated again to the U.S. Most insurance policies state you may be moved to the closest medical facility able to correct care.

- Preexisting circumstances could result in your request for evacuation on the bank card supplier’s expense being denied. Learn your bank card’s full phrases and advantages information to see which excludes these circumstances and the bank card’s definition of a preexisting situation.

- The protection is just for the price of evacuation and medical care throughout transportation. When you’re again on the bottom, you continue to want medical insurance coverage to pay the docs and workers who present care.

- Some playing cards have nation exclusions, so do not count on to move into Syria or Afghanistan and depend on your bank card advantages administrator to get you to a hospital.

Day by day E-newsletter

Reward your inbox with the TPG Day by day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

To get all of the related info, obtain and skim all the part of the advantages information pertaining to those coverages. Listed below are a couple of playing cards providing journey accident and/or emergency evacuation insurance coverage.

The Platinum Card from American Categorical

The Platinum Card® from American Express affords among the many most beneficiant emergency evacuation insurance coverage of any card.

There’s no cost cap, and advantages are prolonged to quick household and youngsters underneath 23 (or underneath 26 if enrolled full-time at school). Better of all, you do not even have to make use of the cardboard to pay for the journey.

You should be on a visit lower than 90 days in size and a minimum of 100 miles away out of your residence. A Premium International Help (PGA) administrator should coordinate every part to not incur any value.

The profit can even pay economic system airfare for a minor underneath 16 to be returned dwelling if left unattended, pay for an escort to accompany that minor if required to get them dwelling and get a member of the family to the place of therapy if hospitalization of greater than 10 consecutive days is anticipated.*

Different American Categorical playing cards supply entry to the Premium Global Assist Hotline. Nevertheless, something they coordinate shall be at your expense. Ensure you learn your Amex card’s advantages information fastidiously.

To study extra, see our full review of the Amex Platinum.

Associated: Your complete guide to Amex travel protections

*Eligibility and profit degree varies by card. Phrases, circumstances and limitations apply. Go to americanexpress.com/benefitsguide for particulars. If permitted and coordinated by Premium International Help Hotline, emergency medical transportation help could also be supplied without charge. In every other circumstance, cardmembers are liable for the prices charged by third-party service suppliers.

Apply right here: Amex Platinum

Chase Sapphire Reserve and Chase Sapphire Most popular playing cards

The Chase Sapphire Reserve® affords two journey accident insurance coverage advantages: frequent provider journey accident insurance coverage and 24-hour journey accident insurance coverage. The previous applies whereas driving as a passenger in, coming into or exiting any frequent provider. The latter applies any time throughout your journey — however you can’t be paid out on each the frequent provider and 24-hour insurance policies.

For those who use your Chase Ultimate Rewards points to e book your journey, you’re lined underneath the cardboard’s advantages.

Folks eligible for protection embody your self, plus “[a] partner, and oldsters thereof; little children, together with adopted youngsters and stepchildren; mother and father, together with stepparents; brothers and sisters; grandparents and grandchildren; aunts or uncles; nieces or nephews; and Home Associate and oldsters thereof, together with home companions and spouses of any particular person of this definition.”

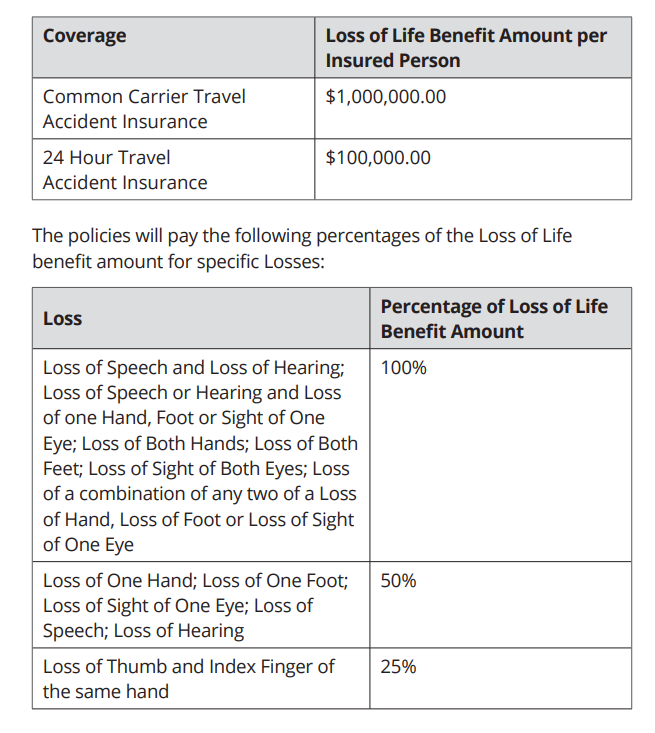

Chase pays as much as $1,000,000 for a typical provider loss and as much as $100,000 for a 24-hour coverage loss based mostly on the next desk:

Some fascinating exclusions with Chase that might forestall a payout embody the insured individual taking part in a motorized vehicular race or velocity contest, the insured individual taking part in any skilled sporting exercise for which they obtained a wage or prize cash, skydiving or if the insured individual touring or flying on any plane engaged in flight on a rocket-propelled or rocket-launched plane.

The Chase Sapphire Reserve additionally affords emergency evacuation insurance coverage. For those who or an instantaneous member of the family paid for a minimum of a portion of your journey with the cardboard, you are eligible for as much as $100,000 in emergency medical evacuation.

Your lined journey should final between 5 and 60 days and be a minimum of 100 miles out of your residence. If you’re hospitalized for greater than eight days, the advantages administrator can organize for a relative or buddy to fly round-trip in economic system class to your location.

In case your unique ticket can’t be used, you may also be reimbursed for the price of an economic system ticket dwelling. In a worst-case scenario, the profit additionally pays as much as $1,000 to repatriate your stays.

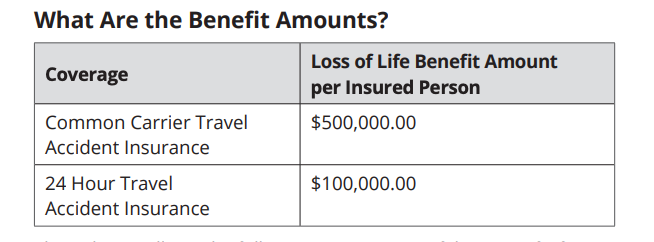

The Chase Sapphire Preferred® Card affords journey accident insurance coverage as effectively, however with decrease payouts on the frequent provider coverage. The advantages pay as much as $500,000 for a typical provider loss and as much as $100,000 for a 24-hour coverage loss based mostly on the next desk:

Ensure to fastidiously learn by your information to advantages in order that you already know what your Chase Sapphire card does and doesn’t cowl.

To study extra, see our full critiques of the Chase Sapphire Reserve and Chase Sapphire Preferred.

Associated: 4 times your credit card’s travel insurance can help with travel woes, and 7 times it won’t

Apply right here: Chase Sapphire Reserve and Chase Sapphire Preferred

United Membership Infinite Card

The highest-tier United Club℠ Infinite Card affords journey accident and emergency evacuation insurance coverage. The journey accident insurance coverage advantages pay as much as $500,000 for a typical provider loss.

The cardboard additionally carries emergency evacuation protection, so you may relaxation assured understanding that you simply’re lined in case of eligible medical occasions. Understand that the United Membership Infinite’s advantages could have phrases that differ from different Chase cards, so learn by your card’s information to advantages for extra info.

To study extra, see our full review of the United Club Infinite Card.

Apply right here: United Club Infinite

Backside line

We hope none of us ever have to fret about both of those insurance policies, but it surely’s good to have peace of thoughts when you or your loved ones want emergency help. This reassurance is another reason to make sure considered one of these playing cards is all the time in your pockets when touring.

The profit guides of all playing cards are up to date frequently, so be sure you do not toss them within the trash when updates present up within the mail and skim the web guides for the most recent phrases and circumstances.

Associated: The best credit cards with travel insurance