The Platinum Card® from American Express and The Business Platinum Card® from American Express have established themselves because the playing cards to have for those who’re fascinated about luxurious journey advantages. With an overlapping rewards construction and comparable advantages, it is logical to query which of the 2 is the most effective for you. Or, if you have already got one of many playing cards, chances are you’ll be questioning whether or not you must also go for the opposite.

It might really work out in your favor to make room for each playing cards in your pockets — even with the $695 annual charges on every (see rates and fees for the Amex Platinum and rates and fees for the Amex Enterprise Platinum).

Every card has advantages to enhance the opposite and vacationers could have no drawback incomes again the steep yearly charges, making them an excellent mixture in the case of getting essentially the most out of your journeys.

This is why it’s your decision each in your pockets.

Unimaginable welcome provide worth

Each playing cards include fairly substantial welcome gives. Proper now, new Business Platinum Card cardmembers can earn 150,000 bonus points after spending $20,000 within the first three months of cardmembership.

With the Amex Platinum, new cardmembers can earn 80,000 bonus factors after spending $8,000 within the first six months of cardmembership (though chances are you’ll be focused for the next provide via the CardMatch Tool — topic to alter at any time and never everybody shall be focused for a similar gives).

For those who apply for each playing cards and earn the complete welcome bonuses, you will get not less than 230,000 Membership Rewards factors. Based mostly on TPG’s March 2025 valuations, that is value $4,600— greater than triple the mixed value of the annual charges.

Associated: Is the Amex Business Platinum worth the annual fee?

Card credit

Each playing cards have a lot of credit to assist cardmembers get worth yr after yr. Enrollment is required for choose advantages; phrases apply.

Day by day Publication

Reward your inbox with the TPG Day by day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Sometimes, one of many best perks to reap the benefits of with the Platinum playing cards is the annual airline payment assertion credit score you will obtain every calendar yr.

Every card has an up-to-$200 annual airline fee statement credit every calendar yr (enrollment required). Whereas it is not as beneficiant because the $300 annual travel credit you will get with the Chase Sapphire Reserve® (which might be utilized to any journey buy), the credit score with the Amex Platinum playing cards remains to be very helpful.

On high of the airline payment credit, the personal Platinum card is loaded with annual gives. Cardmembers get pleasure from the next (some advantages require enrollment):

In the case of annual assertion credit, the Business Platinum isn’t any slouch, both. It gives up to $400 in Dell statement credits every calendar yr (as much as $200 semi-annually), as much as $360 in assertion credit for Certainly per calendar yr (as much as $90 every quarter), up to $200 per calendar year in Hilton statement credits (as much as $50 per quarter), as much as $150 every calendar yr in Adobe assertion credit (topic to auto-renewal) and as much as $120 per calendar yr in assertion credit for purchases with U.S. wi-fi cellphone suppliers (as much as $10 per thirty days). The Dell and Adobe credit will finish on June. 30.

The Enterprise Platinum additionally matches the private Platinum in providing assertion credit for each Clear Plus and your Global Entry or TSA PreCheck utility payment (which you need to use to pay for a frequent journey companion’s utility). These credit are value the identical because the Amex Platinum’s, and are issued in the identical timeframe.

Enrollment is required for choose advantages; phrases apply.

Amex Provides

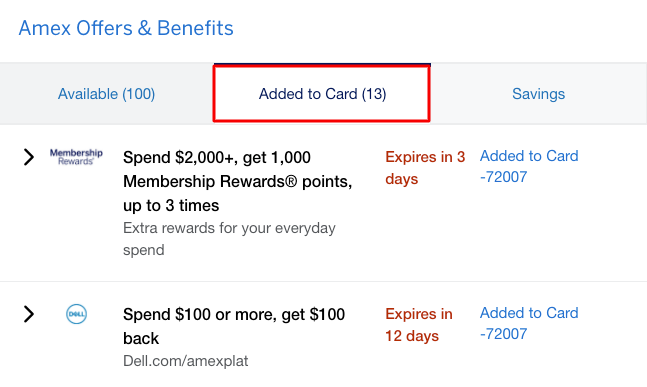

All American Specific playing cards, together with the Platinum and Business Platinum playing cards, include entry to Amex Offers. You’ll find your accessible gives for those who scroll right down to “Amex Provides & Advantages” in your on-line account web page or click on on the “Provides” tab on the Amex app. They’re focused to every cardmember and are available from retailers together with motels, journey suppliers, eating places and clothes and jewellery shops. These gives are often both:

- Spend $X, get Y variety of bonus factors.

- Spend $X, get $Y again.

- Get extra factors for every greenback you spend at a choose service provider.

Whereas Amex Provides is usually a nice deal alone, you are able to do even higher while you stack them with online shopping portals to earn additional money again or bonus factors in your buy.

Be warned: Relying on the phrases of the provide, utilizing on-line portals, promo codes or different financial savings strategies might trigger your Amex Supply to not set off, so at all times learn the superb print within the phrases.

That mentioned, the excellent news is which you can stack the highest Amex Provides with different widespread Amex perks, together with among the annual assertion credit that include the Platinum and the Enterprise Platinum playing cards. Eligibility for these gives is restricted. Enrollment is required within the Amex Provides part of your account earlier than redeeming.

Associated: Your ultimate guide to Amex Offers

Journey advantages

Cardmembers have entry to a wide range of insurance policies when booking travel and going shopping with their card, together with:

- Journey cancellation and interruption insurance coverage*

- Journey delay insurance coverage*

- Cellphone safety*

- Baggage insurance coverage**

- Buy safety**

- Return safety**

- Prolonged guarantee**

*Eligibility and profit degree varies by card. Phrases, situations and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by New Hampshire Insurance coverage Firm, an AIG Firm.

**Eligibility and profit ranges range by card. Phrases, situations and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by AMEX Assurance Firm.

Some playing cards have eradicated these protections over the previous few years, so these advantages present one more reason to ebook your journey with an Amex Platinum.

The Platinum playing cards not solely shield you from a number of journey disasters however may also improve your journey expertise.

The Platinum playing cards get you entry to The Global Lounge Collection, giving cardmembers free entry into any Amex Centurion Lounge plus entry to a lot of extra airport lounges as properly. Entry is restricted to eligible cardmembers. General, the gathering grants entry to over 1,400 VIP lounge areas throughout 140 international locations — a really useful profit.

Certainly to be sought out by frequent flyers, the Platinum playing cards additionally present some supplemental advantages to make travels a bit simpler: Platinum Journey Service counselors can assist set an itinerary to take advantage of your journeys, whereas World Eating Entry by Resy can get you into your most desired eating places. Most popular Entry is even a strategy to snag exclusive seats at cultural and sporting events.

Enrollment is required for choose advantages; phrases apply.

Resort advantages

One space the place these two playing cards overlap is entry to an array of hotel benefits. With each the private and enterprise Amex Platinum, you will obtain complimentary Gold standing at Hilton and Marriott and have entry to Amex Fine Hotels + Resorts. Enrollment is required for choose advantages; phrases apply.

Gold standing at Hilton comes with perks like complimentary breakfast, room upgrades when accessible and an 80% level bonus on paid stays. Marriott Bonvoy Gold standing comes with advantages equivalent to precedence late checkout, upgrades when accessible and a 25% level bonus.

Amex Advantageous Accommodations + Resorts is a program that provides elitelike advantages at properties all over the world. These perks embrace assured late checkout, every day breakfast for 2, room upgrades when accessible and a singular property amenity (valued at $100 or extra).

Some properties on this program may also provide third, fourth or fifth nights free, which is a useful profit while you’re not trying to make use of your resort factors for a keep.

When you solely want one Platinum card to get pleasure from these advantages, having each ensures you are making the most of advantages whereas maximizing incomes, whether or not your journey is for enterprise or pleasure.

Maximizing private and enterprise spending

Maybe one of many greatest advantages of getting each the private and enterprise variations of the Amex Platinum is which you can successfully earn 7.7% again on each airfare buy you place in your private Platinum Card (airfare booked instantly with the airline or by way of American Specific Journey earns 5 factors per greenback on as much as $500,000 spent on these purchases per calendar yr; 1 level per greenback thereafter). This incomes price additionally holds true for pay as you go motels booked by way of Amex Journey.

It’s because, when you have got the Enterprise Platinum Card, you have got the power to Pay with Points to ebook flights with Amex Journey, and doing so will get you 35% of your factors again (as much as 1 million factors per calendar yr). This basically will get you a price of 1.54 cents per level.

For those who earn 5 factors per greenback on eligible journey purchases after which redeem these factors at a price of 1.54 cents, you are getting a return of seven.7%.

That mentioned, for those who maximize American Specific’s array of useful switch companions, you might be able to get much more worth. In spite of everything, TPG values Amex Membership Rewards factors at 2 cents apiece as of our March 2025 valuations.

One thing else to contemplate is that the Amex Business Platinum earns 1.5 factors per greenback on U.S. development materials and {hardware} purchases, U.S. electronics, cloud system suppliers and software program purchases and U.S. transport suppliers. To high it off, the Enterprise Platinum additionally earns 1.5 factors per greenback on purchases of $5,000 or extra. Purchases that earn 1.5 factors per greenback are restricted to the primary $2 million each calendar yr (1 level per greenback thereafter).

Say, for instance, you make an $11,500 buy, and also you would not be eligible for a bonus with one other card. In whole, you’d earn 17,250 Membership Rewards factors on the Enterprise Platinum card — value about $345 based mostly on TPG’s valuations.

For those who had been to make use of one other eligible Amex card with no class bonus for what you are shopping for, you’d earn 11,500 Membership Rewards factors — value about $230.

Successfully, you would be getting greater than $100 additional in worth through the use of the Enterprise Platinum.

Associated: How to maximize your earning with the Amex Business Platinum

Backside line

Utilizing each the private Amex Platinum Card and the Enterprise Platinum Card can get you the utmost worth on each your rewards-earning and redemptions, along with some nice cardmember perks.

The combo is ideal for business-owning vacationers who’ve a excessive funds and wish to reap the benefits of large financial savings, beneficiant credit and splendid journey alternatives.

Though the annual prices are excessive, the fitting cardmembers could have no problem getting large worth out of this pairing. Every is a superb card by itself, however having each in your pockets can get you much more Membership Rewards factors and assist you to stretch these factors additional when it comes time to make use of them for journey.

To study extra, learn our full opinions of the Amex Platinum and Amex Business Platinum.

Apply right here: Amex Platinum

Apply right here: Amex Business Platinum

For charges and charges of the Amex Platinum card, click on here.

For charges and charges of the Amex Enterprise Platinum card, click on here.